Multifamily Real Estate

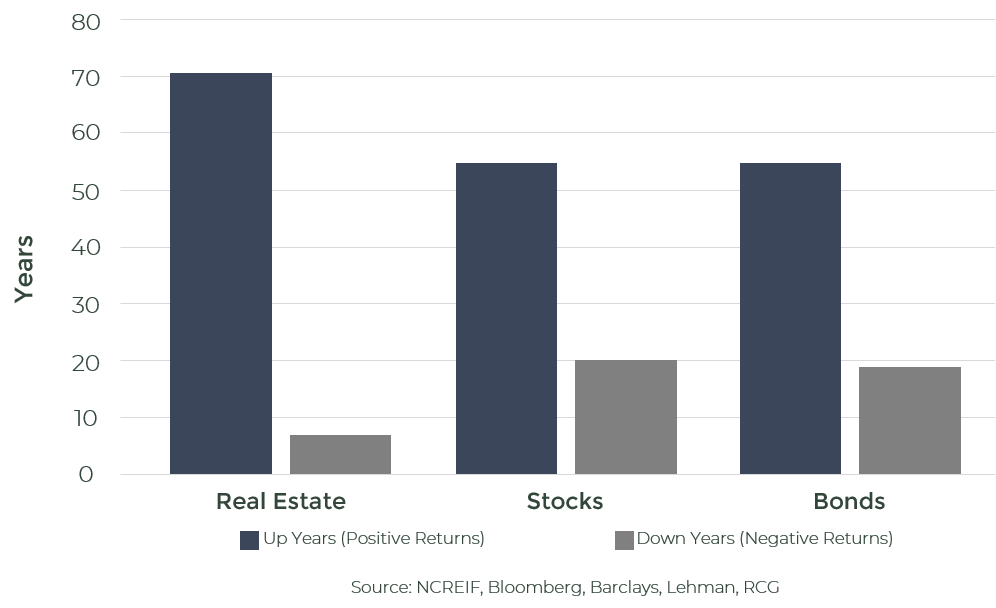

Multifamily real estate stands out in today’s investment landscape, offering strong returns with lower risk.

Over the past 40 years, this asset class has consistently outperformed other forms of real estate. With the U.S. population expected to exceed 380 million within the next 25 years, demand for multifamily housing is on the rise—further reinforcing the long-term appeal of investing in these properties.

Financial Freedom Through Real Estate Investing

Real estate investing offers an unmatched combination of stability and growth potential, making it an exciting avenue for wealth creation. Multifamily apartments, in particular, stand out as a resilient asset class, providing consistent cash flow through rental income and the opportunity for long-term appreciation. With demand for housing continually on the rise, multifamily properties benefit from a broad tenant base, minimizing risk and enhancing predictability. Moreover, these investments offer significant tax advantages and a hedge against inflation, making them a smart choice for diversifying your portfolio and building lasting wealth.

Targeted Investor Returns and Advantages of Ownership

• Cash-flowing assets with a 7% LP preferred return

• Average IRRs of approximately 17% annually, achieved through capital appreciation upon sale

• Equity growth as loan principal is paid down over time

• Conservative use of leverage to enhance equity returns

• Significant tax advantages via depreciation pass-through

• Low correlation with other asset classes, providing protection against stock market volatility

Our Investment Criteria:

• Class A and B properties in secondary and tertiary markets

• Workforce housing, 150 units+, late 90’s vintage or newer

• 90% occupancy or better

• Cap Rates 5.5% - 7.5%

• Value-add deals, typically invest $10,000 -$20,000 per unit to upgrade and looking for monthly rent increases $150-300 per unit

• Purchase price $10M to $50M

• Open to Co-Sponsorship opportunities

The Benefits of Investing Through Syndications

At Acuity Partners, we believe that real estate syndications offer an exceptional opportunity for individuals seeking to build sustainable wealth through commercial real estate. Real estate syndications provide a collaborative investment model, where investors pool their resources to acquire real estate assets, that we, as sponsors, operate. This strategy offers a passive investment opportunity, allowing investors to benefit from owning large rental properties without the responsibility of day-to-day management.

Over the past decade, U.S. multifamily real estate has become one of the most sought-after sectors by institutional investors. This is due to its essential nature, strong property-level fundamentals, and historically high risk-adjusted returns. Multifamily properties have remained a cornerstone of commercial real estate (CRE) portfolios, making up 29.1% of the NCREIF Fund Index-Open End Diversified Core Equity (NFI-ODCE). We anticipate that well-located, high-quality rental housing will continue to perform strongly over the long term, supported by a variety of macroeconomic, demographic, and financial factors.

By investing through syndications, individuals can tap into this growth potential and diversify their portfolios with high-quality real estate assets while minimizing the complexities of active property management.

Get closer with projects

Current Portfolio

Elevate at Dawson Forest - Dawsonville, GA

Elevate at Dawson Forest – Recent Acquisition<br> Location: Dawsonville, GA<br> Property: 268-Unit, Class B Multifamily (Built 1998)<br> Acquisition: April 2024 at $52M<br> Estimated Hold: 4-5 years<br> Business Plan:<br> Dawson County’s above-average population growth has created a significant supply/demand imbalance, with Elevate being one of only four multifamily properties in the market. With only 32% of units renovated to premium standards, we plan to upgrade the remaining 68% to capture an estimated $300 rent premium per unit. For instance, renovated 2-bedroom units command about $1,650 per month versus $1,350 for unrenovated units. Our value-add strategy is expected to boost NOI by roughly 45% over a five-year hold, targeting a 20%+ IRR after four years. Even though we acquired the property in April 2024, we are already witnessing above-average rent growth on both renewals and new leases.

Enclave at West Ashely - Charleston , SC

Terraces at Perkins Rowe - Baton Rouge, LA

The Strength of Multifamily Investments

Acuity Partners believes that well-located, high-quality rental housing will continue to be a strong performer over the long term due to a variety of macro, demographic, and financial factors.

Our Partners