Targeted Investor Returns and Advantages of Ownership

• Annual cash flows distributed to investors 6-8% (paid quarterly)

• Average IRRs 15%+/- annually through capital appreciation upon sale

• Equity build up overtime as loan principal is paid down from cash flow

• Use of leverage increases return on equity

• Tax efficient investment due to deal structure and depreciation pass-through

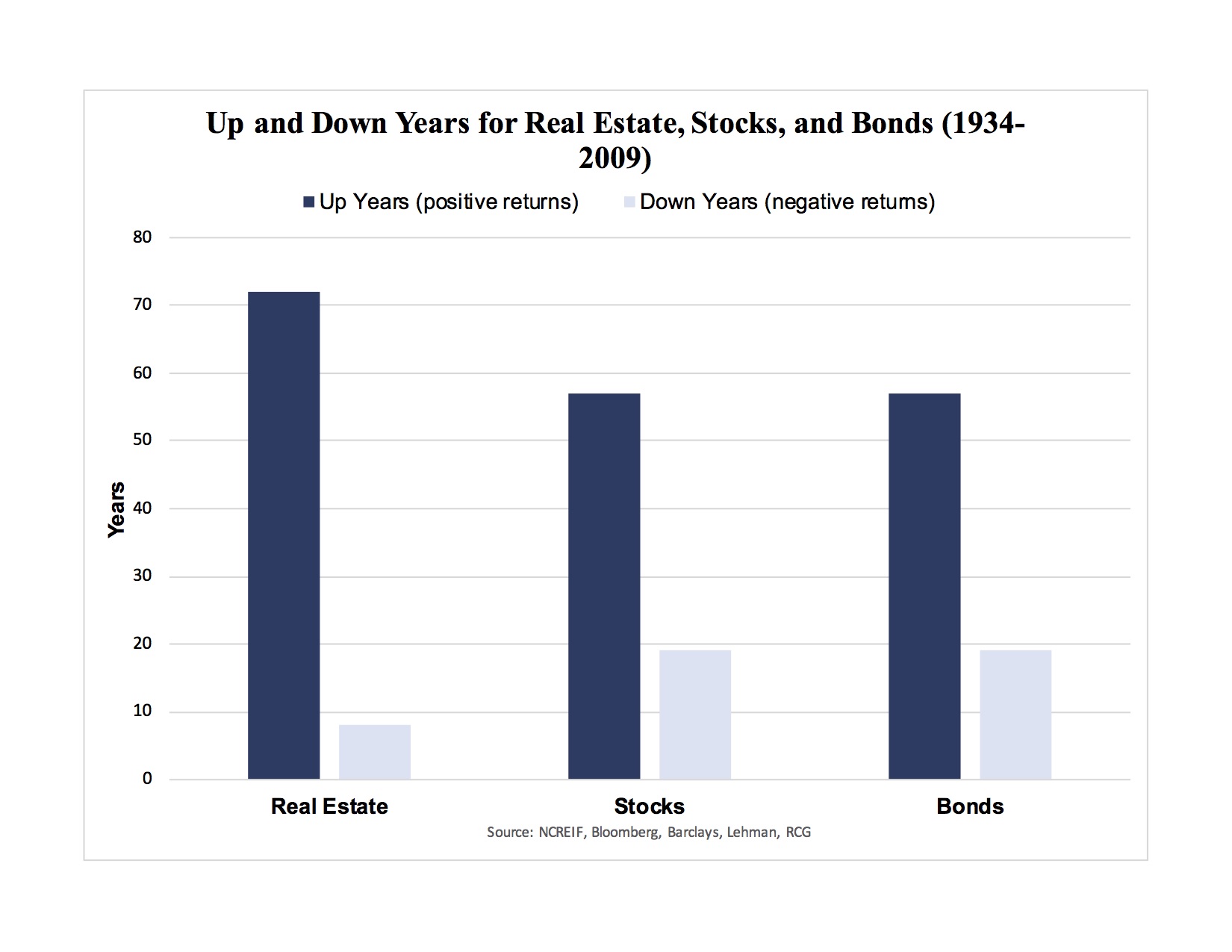

• Not correlated to other asset classes. Protects against stock market volatility

Our Investment Criteria:

• Class B/C properties in secondary markets

• Workforce housing, 150 units+ (prefer 200-400), late 80’s vintage or newer.

• 90% occupancy or better. Cap rates 5.5%-7%

• Value-add deals, typically invest $5k-$15k per unit to upgrade and looking for monthly rent increases $100-$150 per unit

• Purchase price $10mm-$40mm Equity $3mm-$15mm per deal

• Open to Co-Sponsorship opportunities

For years, institutional investors have used commercial real estate to enhance yields in a yield-starved market. Real estate can offer predictable cash flows, build equity through future capital appreciation of the assets, tax benefits, and may act as a hedge against inflation and stock market risk. Our platform is designed to provide individual investors the same benefits.

We collaborate with our clients to provide a transparent investment process, enabling more efficient decision-making. Our direct access allows clients to invest alongside experienced operating partners who have a proven track-record of delivering attractive risk-adjusted returns.

This approach differs from the large brokerage firms who typically only offer these types of investments through a fund platform or in publicly traded REITs. Similarly, most of the well-known real estate funds require a minimum investment of $1 million of more which does not appeal to the typical investor. Acuity Partners utilizes its vast network of commercial brokers, lenders, other sponsors/owners, and legal and accounting professionals to identify what we believe are best of breed transactions.

At Acuity, our core real estate strategy involves identifying and acquiring commercial multi-family properties, with an emphasis on workforce housing in robust markets. Our Metropolitan Statistical Area (MSA) analysis concentrates on metrics of positive population, employment and income growth, strong infrastructure, diversified local economy and a favorable business climate. We typically underwrite over a 1000 deals a year looking for healthy operating metrics and value-add opportunities that can be acquired at favorable prices.

Our strategy will help you and your family create multi-generational wealth. Our objective is to identify projects that will provide current cash flow, preservation of capital, and tax-efficient capital appreciation. We hope to meet our objective by acquiring stabilized, value-add Class B/C properties in secondary markets.

Purchase Date: April 2023 – $16,100,000

Units: 112

Purchase Date: December 2020 – $16,000,000

Property Class: B+, Units: 106

Press Release: Acuity Partners adds 106-unit Property to its Portfolio

Purchase Date: October 2021 – $21,400,000

Property Class: B+, Units: 213

Press Release: Acuity Partners, Electra Capital and Avid Realty, Acquire 2nd Multifamily Property in Texas

Purchase Date: March 2020 – $36,200,000

Property Class: B+, Units: 330

Press Release: Acuity Partners adds 330-unit Property to its Portfolio“

Purchase Date: November 2022 – $44,900,000

Units: 226

Purchased Date: May 2022 – $48,800,000

Units: 342

Purchase Date: December 2018

Property Class: A Luxury, Units: 152

Purchase Date: September 2021 – 13.200,000

Sold Date: September 2023

Property Class: B, Units: 112

Press Release: Acuity Partners and DXE Properties Acquire Jasmine Place Apartments in Savannah, Georgia

Purchased Date: December 2016 – $3,800,000,

Sold Date: July 2018 – $5,000,000

Property Class: C-, Units: 118

Purchase Date: February 2019 – $8,500,000

Sold Date: October 2021

Property Class: B-, Units: 164

Purchase Date: July 2016 – $11,700,000

Sold Date: March 2020 – $17,200,000

Property Class: B-, Units: 212

Purchase Date: February 2018 – $22,000,000

Refinanced Date: October 2022 – full return of investor capital

Property Class: B, Units: 270

Purchase Date: June 2017 – $14,300,000

Refinanced Date: January 2023 – full return of investor capital

Property Class: C, Units: 254

Acuity Partners | 295 Madison Avenue, New York, NY 10017 | 212-652-2292

Disclaimer:

This site is operated by Acuity Partners LLC (“Acuity Partners”), which is not a registered broker-dealer. Acuity Partners does not give investment advice, endorsement, analysis or recommendations with respect to any securities. Acuity Partners has not taken any steps to verify the adequacy, accuracy or completeness of any information. Neither Acuity Partners nor any of its officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this site or the use of information on this site. Investing in any of our offerings poses risks, including but not limited to credit risk, interest rate risk, and the risk of losing some or all of the money you invest. (1) Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. (2) conduct your own investigation and analysis; (3) carefully consider the investment and all related charges, expenses, uncertainties and risks, including all uncertainties and risks described in offering materials; and (4) consult with your own investment, tax, financial and legal advisors. Investments are only suitable for accredited investors who understand and willing and able to accept the high risks associated with private investments. Neither the Securities and Exchange Commission nor any federal or state securities commission or regulatory authority has recommended or approved any investment or the accuracy or completeness of any of the information or materials provided by or through the website. Investors must be able to afford the loss of their entire investment. Investments in private placements are speculative and involve a high degree of risk and those investors who cannot afford to lose their entire investment should not invest.

Not all pre-IPO companies will go public or get acquired, and not all IPOs or acquisitions will result in successful investments. There are inherent risks in pre-IPO investments, including the risk of loss of the entire investment, illiquidity, and fluctuations in value and returns. Past performance is not indicative of future returns.

Copyright© 2022 Acuity All Rights Reserved