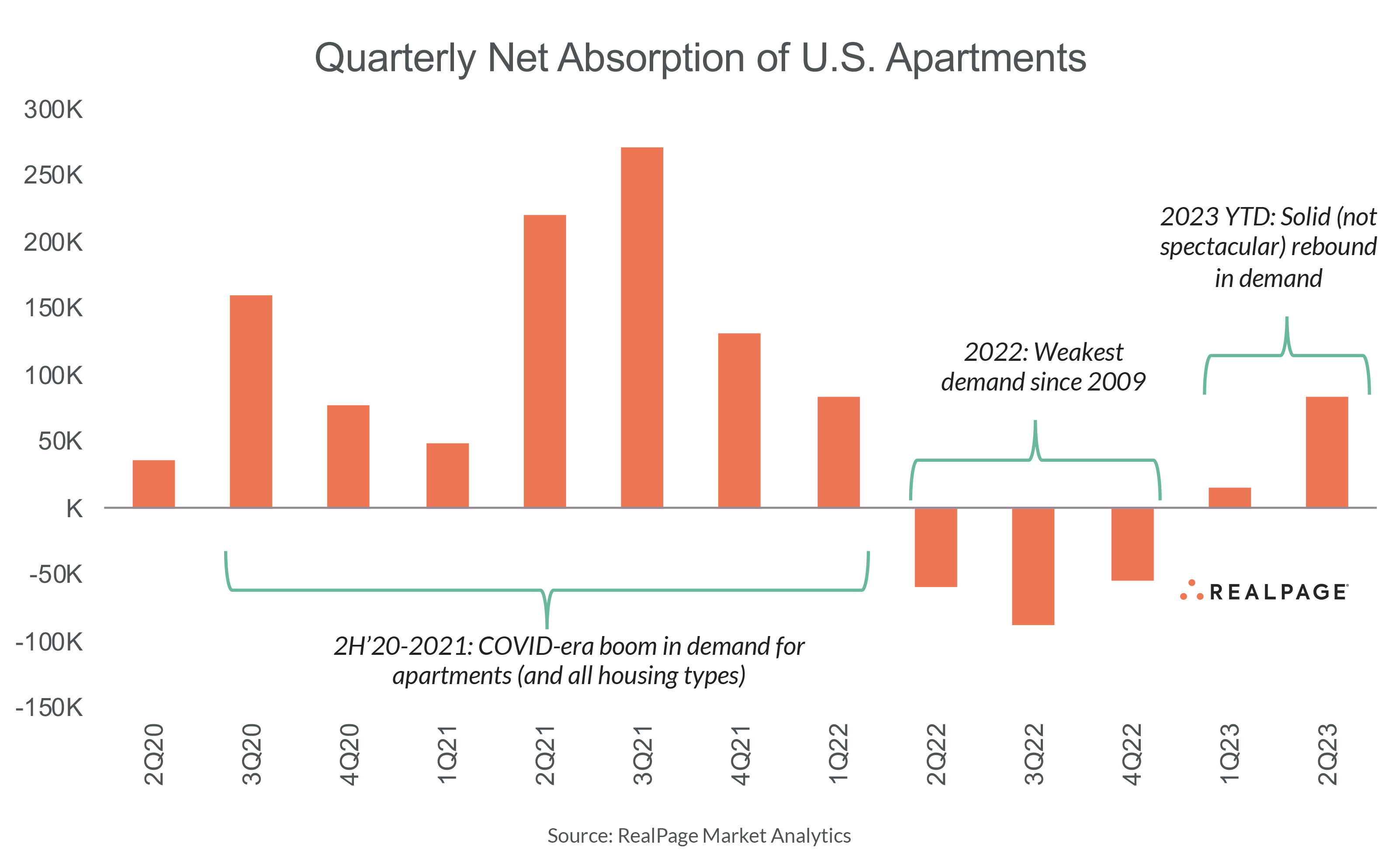

While rent growth continues to cool rapidly, apartment demand is rebounding so far in 2023. Net absorption came in just shy of surging new supply levels in 2nd quarter 2023, stabilizing occupancy rates after a precipitous decline in 2022.

Net demand registered at 83,449 units in 2nd quarter, according to RealPage data. That marked a five-quarter high but was well below the record numbers seen during the 2021 boom.

Apartment demand appears to be normalizing as expected so far this year. That’s good news, but it’s still not enough to keep pace with new supply – and likely won’t be as completions peak later this year and well into 2024.

Through the first half of 2023, more than three-fourths of net new demand has gone to the Sun Belt or Mountain region, led by Houston, Phoenix, Dallas/Fort Worth, Charlotte, Nashville and Austin. Demand hotspots elsewhere included Chicago, Washington, DC and Northern New Jersey. Conversely, net demand was more limited along much of the West Coast.

The demand rebound comes just as the 50-year high in apartment construction begins to convert into peak completions. More than 107,000 apartment units completed in 2nd quarter 2023, and RealPage is tracking more than 1 million additional units under construction at the end of June.

Completions are expected to remain elevated through 2024 before easing in 2025. Ongoing construction tops 25,000 units in 17 markets across the country, led by Dallas/Fort Worth, Phoenix, New York, Austin, Northern New Jersey, Houston, Atlanta and Washington, DC.

Demand continues to go where supply is going, which is normal. Demand may not stay in lockstep with supply in the short term, but in the longer term, there’s still a need for more housing.

So far in 2023, solid demand is helping mitigate supply-fueled vacancy spikes in most markets. As of June, U.S. apartment occupancy came in at 94.7%, down only 0.1 percentage point since January. By comparison, occupancy fell 1.2 percentage points in the first half of 2022, and then an additional 1.4 percentage points in the second half of the year.

Nearly all major markets reported occupancy rates around or above 93% in June, with the only exceptions being Memphis (92.1%) and San Antonio (92.2%).

Rent Growth Remains Well Below Normal in 2023

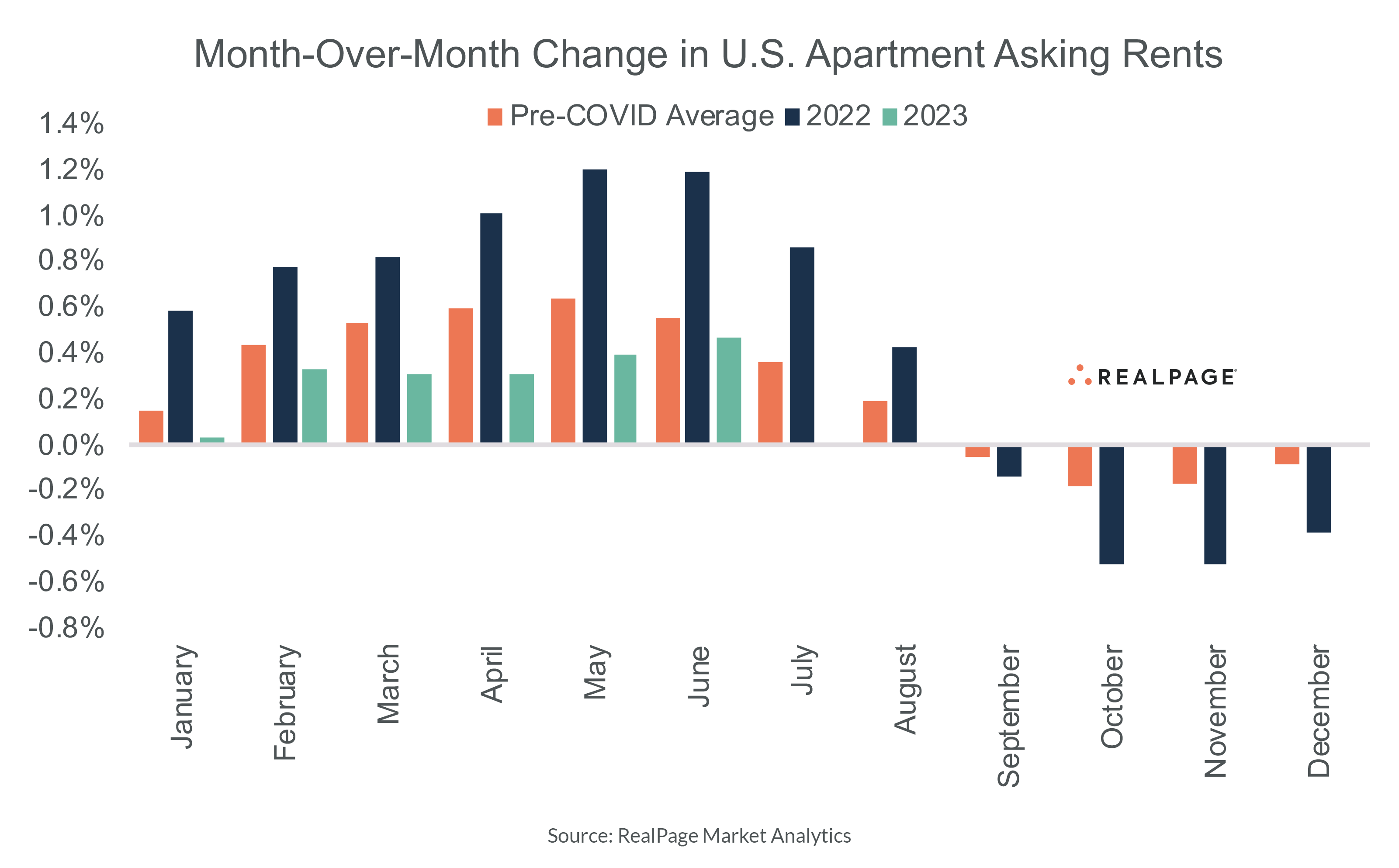

Asking rents, meanwhile, continue to grow but at very muted levels – as they have in every month so far in 2023. Same-store effective asking rents rose just 0.46% between May and June 2023. That was the smallest increase for any June in the last decade aside from the lockdown period of June 2020.

Apartment operators continue to prioritize occupancy rates over rents. Occupancy came easy back in 2021 because there was so much more demand than supply. The tables have turned. And now supply is doing exactly what it’s supposed to do – giving renters more options and putting downward pressure on rent growth.

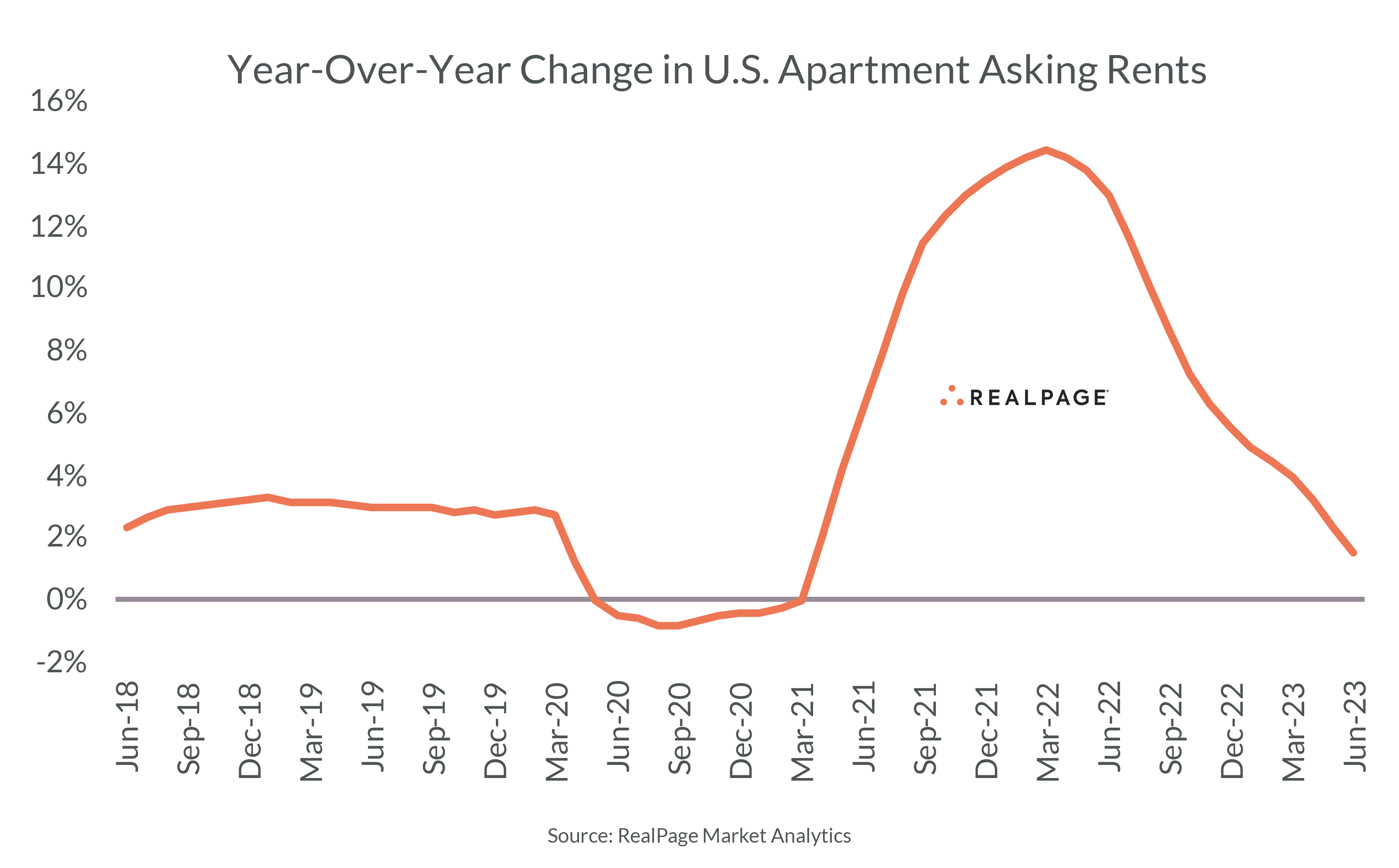

Year-over-year, effective asking rent growth came in at 1.5%, the lowest since early 2021. Year-over-year rent change is now on pace to flatten or even turn slightly negative later this summer.

The number of individual metro areas with year-over-year rent cuts continued to grow in June, reaching 35 of the nation’s 150 largest markets.

Rents Falling – and Not Just in the Sun Belt

Much multifamily commentary today centers around potential oversupply in the Sun Belt, but it’s not quite that simple. Supply is a big factor all across the country, while some markets are still struggling to generate much demand. As a result, rents are falling in key markets across multiple regions – especially in the South, Desert and Mountain regions and along the West Coast.

Boise, a pandemic-era boom market, led the nation with a 6.2% year-over-year cut in effective asking rents. Phoenix (-4.7%) and Las Vegas (-4%) followed, with three others – Vallejo/Fairfield/Napa, CA, Fort Walton Beach, FL, and Reno, NV all cutting rents between 3 to 4%.

Other notable markets with cuts in asking rent included Austin (-2.9%), Jacksonville (-2.7%), Sacramento (-2.3%), Salt Lake City (-1.4%) and Atlanta (-1.3%). Two Bay Area markets (San Francisco and Oakland) are both now in the red, too, as are Portland and Riverside. Seattle and Los Angeles are among the markets near 0% and likely to soon turn negative.

Aside from some of the West Coast, demand isn’t the issue in most of the markets cutting rents. There’s a lot of demand for apartments this summer, but it’s just not enough to keep pace with supply in the short term. New construction creates more options and therefore more favorable pricing for renters.

On the flip side, rent growth remains more solid across the Midwest and much of the Northeast – as well as in college towns across the country. Some of the largest rent increases nationally (6% to 10%) came in college towns like Madison, WI, Champaign-Urbana, IL, Knoxville, TN, College Station, TX and Fayetteville, AR.

College town dynamics are very different from most major metro areas. In most college towns, construction slowed down in 2020 and 2021 as many campuses closed during the pandemic. Now, students are back on campus at the same time new supply is very limited.

Among top 50-sized markets, only 15 recorded rent growth north of 3%, led by Northern New Jersey and Cincinnati (both 6%) and Indianapolis (4.8%).

Source: RealPage – Jay Parsons